Just a few weeks ago, the price of Solana was separated from the historic maximum of 40%. Now she needs only 15% growth to set a new record

macroeconomics is now associated with politics. If you have doubts, look at the prices of assets such as Solana after Donald Trump won the US presidential election. Let’s figure out what might happen next to the price. SOL.

Read more: What is Solana (SOL). Overview of the project and its prospects

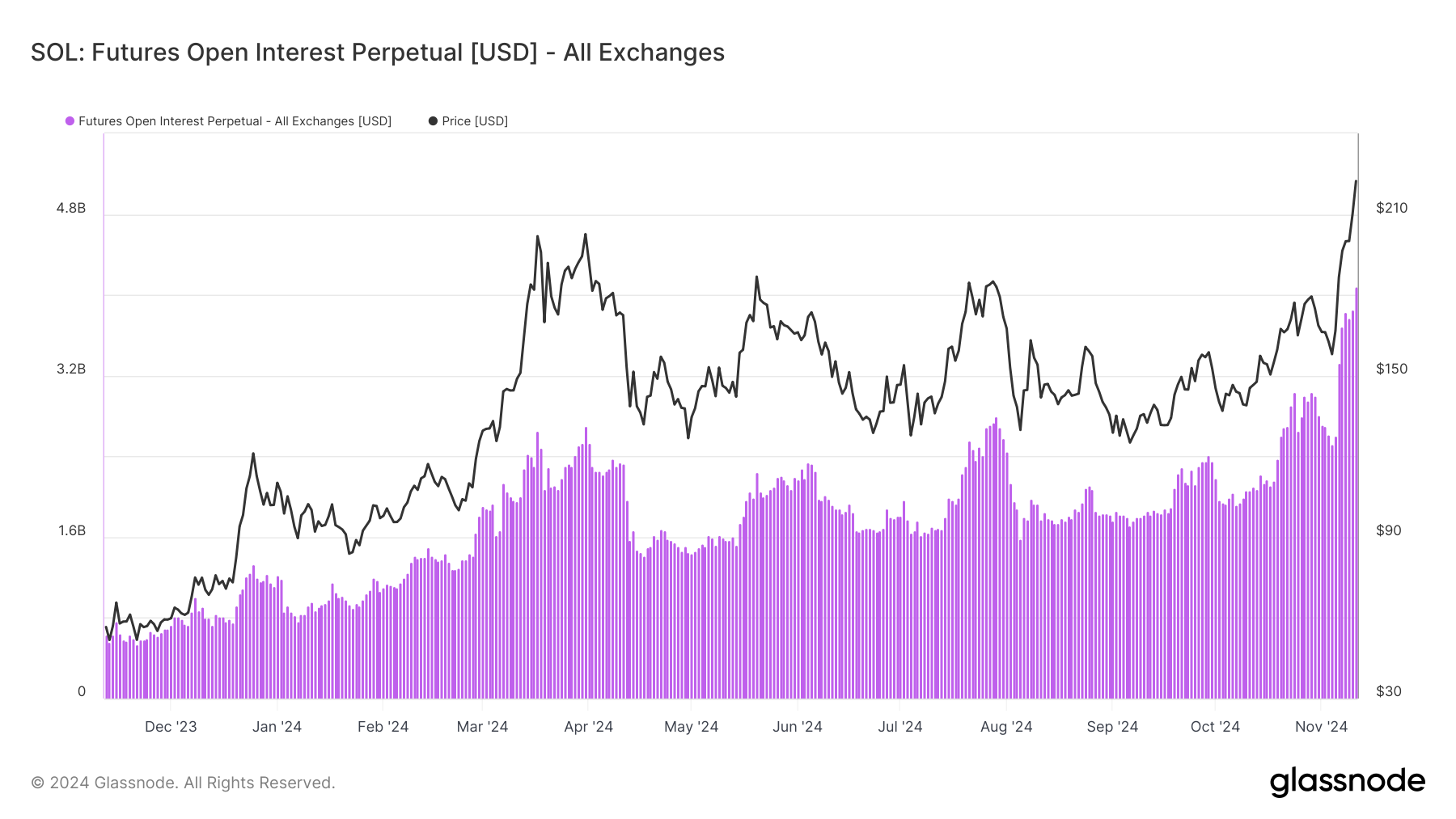

Solana’s open interest has reached record levels

The historic maximum for Solana on $260 was reached in November 2021. In March of this year, altkoin tried to exceed this level, but bounced off. This led to a decrease in the double-digit price.

However, the situation has changed since last week: the price has risen by 37% over the past seven days. This growth brought it closer to its historical maximum. Now, to test this mark, the token needs to grow by only 15%.

In addition, according to Glassnode, open interest by SOL reached record $4 billion This onchain-metric reflects the total number of currently unclosed contracts for various derivatives such as options and futures. Its growth suggests that more market participants are in new positions. A decrease in the indicator, on the contrary, indicates a decrease in activity and withdrawal of money from the market.

The growing open interest in Solana suggests that with the influx of new money into contracts, the price may rise higher.

Sharpe coefficient — is an indicator that suggests that SOL can reach a historic maximum in the near future. He estimates the return on investment with risk correction, given the volatility. A high coefficient indicates an attractive ratio of risk and reward. If its value is below zero, potential profit may not cover possible risks.

According to Messari, Sharpe coefficient for SOL rose to 0.48. This significant improvement indicates that buying an asset at the current price can bring decent profit to investors.

SOL forecast: waiting for levels above $260

On the daily schedule, the price collided with resistance at $222.26. However, the cash flow indicator of Chaikin Chaikin Money Flow (CMF) suggests that this resistance cannot stop growth.

Metric measures the movement of cash flows entering and leaving the asset. Positive values indicate that buyers are investing to maintain price growth. Meanwhile, negative indicators indicate that the initiative is on the side of sellers, and liquidity leaves the asset.

Now the indicator is 0.23, which indicates an increase in pressure from buyers. With support on $186.58, Solana’s new record maximum may be just around the corner. Perhaps the rally is higher than $260.

However, bear pressure will cancel this forecast. In this case, the price SOL may drop to $157.89.

No Comments